Payroll Processing

Payroll

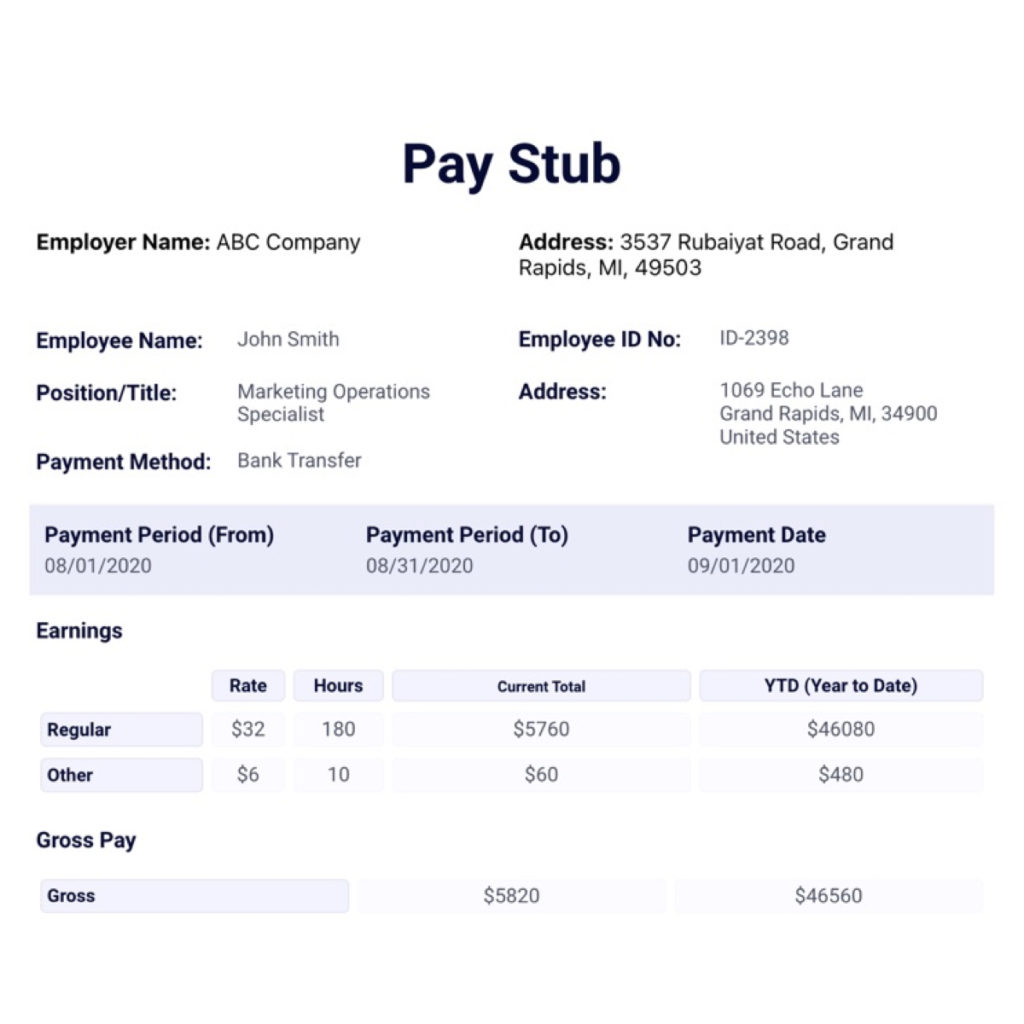

At Clockit, we understand the critical role that accurate and efficient payroll processing plays in your business. Our cutting-edge payroll solution is designed to streamline your operations, automate time-consuming tasks, and minimize errors. It is incredibly user-friendly, ensuring an error-free payroll process regardless of your company’s size or industry. Whether you’re dealing with multiple pay rates, shift differentials, or a variety of tax regulations, Clockit’s sophisticated algorithms can handle it all seamlessly. With Clockit, you are not just managing payroll; you’re creating a happier and more productive workspace where transparency and accuracy drive trust. Harness the power of efficiency with Clockit’s payroll system – because your time is meant for things greater than managing payrolls.