14 Jul Paystub

What is a Paystub?

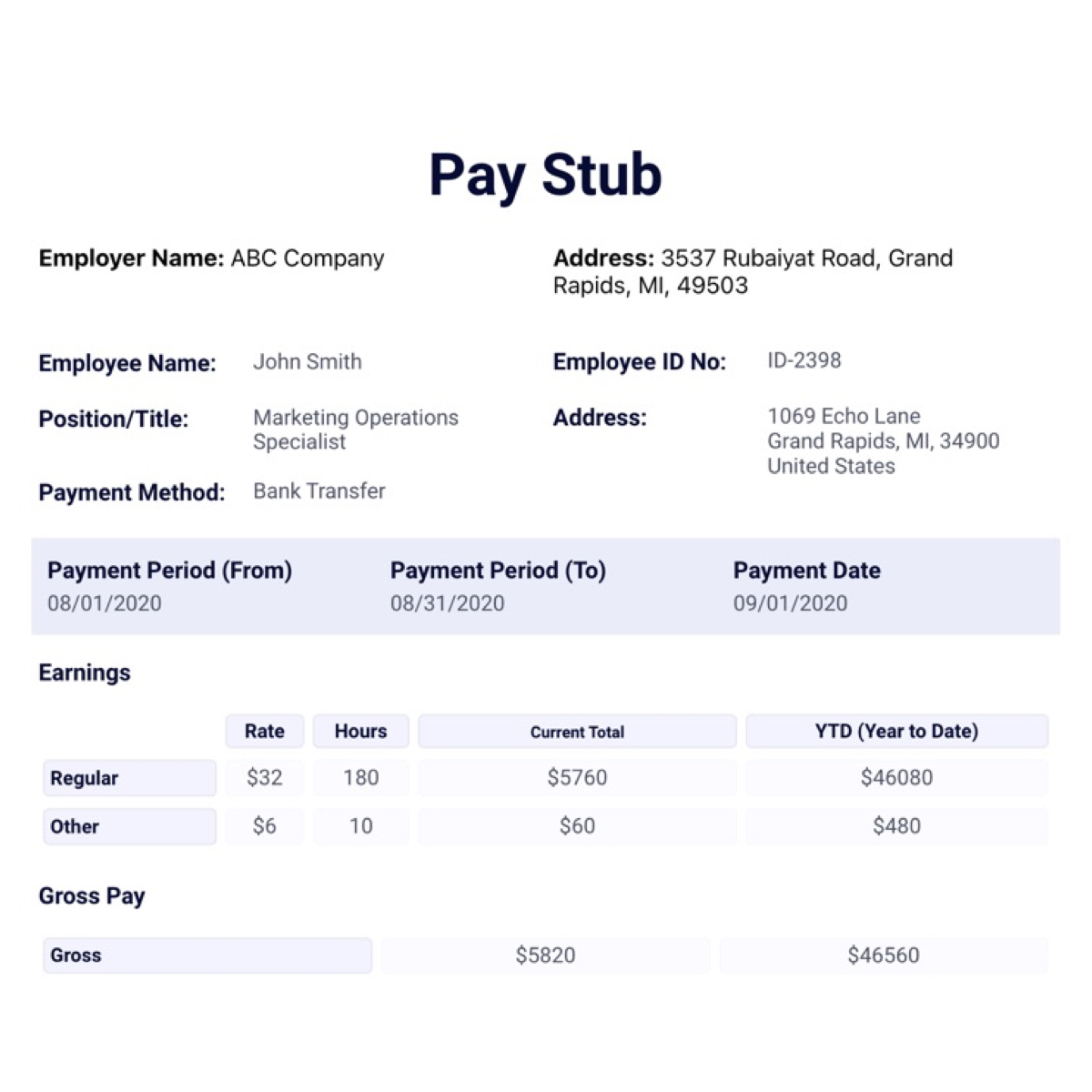

A paystub, also known as a paycheck stub, pay stub, or pay slip, is a document provided to employees by their employer that outlines the details of their earnings for a specific pay period. It serves as a record of the employee’s wages, deductions, and net pay.

Typically, a paystub includes the following information:

1. Employee Information:

This section includes the employee’s name, address, and sometimes their social security number or employee ID.

2. Employer Information:

It contains details about the employer, such as the company name, address, and contact information.

3. Pay Period:

The paystub specifies the dates for which the payment is being made, such as the start and end dates of the pay period.

4. Earnings:

This section provides a breakdown of the employee’s earnings for the pay period. It usually includes regular wages, overtime pay, bonuses, commissions, and any other forms of compensation.

5. Deductions:

Here, the paystub lists various deductions made from the employee’s earnings. Common deductions may include federal and state income taxes, Social Security and Medicare taxes, health insurance premiums, retirement contributions, and other voluntary deductions like union dues or employee benefits.

6. Taxes:

This part of the paystub shows the amounts withheld for different types of taxes, such as federal income tax, state income tax, and local taxes.

7. Net Pay:

The net pay, also known as take-home pay or net earnings, represents the amount the employee actually receives after all deductions have been subtracted from their gross earnings.

8. Year-to-Date (YTD) Information:

This section summarizes the employee’s earnings and deductions from the beginning of the calendar year up to the current pay period. It helps employees track their total income and deductions for tax and financial purposes.

Paystubs are important for employees as they provide a detailed breakdown of their earnings and deductions, allowing them to verify the accuracy of their pay and understand the various components that contribute to their net pay. They also serve as proof of income for loan applications, rental agreements, and other financial transactions.

Know more about how ClockIt can help with paystub calculations.