31 Jul 8 Tips to Avoid Payroll Errors

The Impact of Payroll Errors on Employee Morale and Company Reputation

Payroll processing is a complex and vital component of any organization’s operations. It’s not just about calculating and issuing salaries; it involves meticulous record-keeping, compliance with various tax and labor laws, and more. But despite its importance, payroll errors are common, and they can have far-reaching implications beyond the immediate financial impact. These errors can negatively affect employee morale, damage a company’s reputation, and even lead to legal complications.

Impact on Employee Morale:

Employee morale is closely linked with how a company handles payroll. An organization that consistently delivers accurate and timely pay fosters a sense of trust and reliability among its workforce. Conversely, payroll errors can lead to frustration, distrust, and decreased job satisfaction. For instance, underpayments can create financial distress for employees, and overpayments can lead to uncomfortable situations where the company needs to reclaim excess funds.

Studies have shown that financial instability is a significant contributor to employee stress, and payroll mistakes directly contribute to this. High-stress levels can result in decreased productivity, lower engagement, and higher turnover rates, all of which impact the bottom line.

How Payroll Errors Impact on Company Reputation:

In today’s interconnected world, reputation is everything. A company’s reputation can impact its ability to attract and retain talent, its relationships with stakeholders, and even its market value.

A series of payroll errors can lead to negative online reviews and social media chatter, eroding a company’s reputation. Case in point, a major retail company experienced this firsthand when an error led to widespread underpayments. The issue not only caused financial distress for the employees but also resulted in a public relations disaster that took years to recover from.

Further, payroll mistakes can attract the attention of regulatory bodies, leading to fines and public reprimands. These incidents are usually public, causing reputational damage and negatively affecting shareholder confidence.

Preventative Measures:

Proactively fixing payroll errors is an integral part of maintaining employee satisfaction and a company’s reputation. Here are some practical steps an organization can take:

Invest in Payroll Software:

Payroll software can drastically reduce human errors. Look for a system that offers automatic tax calculations, compliance updates, and integration with time-tracking systems. Know more about ClockIt

Regularly Audit Payroll Records:

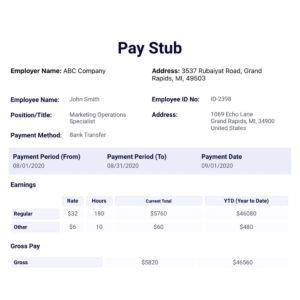

Conducting regular audits helps identify discrepancies and errors early on. Audits should be comprehensive, covering all aspects such as time cards, salary rates, tax withholdings, and benefits deductions.

Comprehensive Training:

Ensure that payroll staff are well-versed with the complexities of the payroll process and updated on the latest labor laws, tax regulations, and company policies. Continuous education and training will minimize errors.

Create a Payroll Calendar:

A well-defined payroll calendar with critical dates for tax filing, wage disbursal, and year-end documentation can help avoid last-minute rush and errors.

Clear Communication:

Establish open communication channels between the payroll department and the rest of the organization. This will encourage employees to promptly report any payroll discrepancies, allowing for quicker resolution.

Implement a Robust Error Resolution Process:

Even with all precautions, errors can occur. Have a formal error resolution procedure in place. This process should be transparent, fair, and prompt to maintain trust among the employees.

Establish a Payroll Policy:

Have a clear payroll policy that details the payment schedule, timekeeping and overtime rules, and payroll correction procedures. Ensure that all employees are familiar with this policy.

Outsource Payroll Processing:

If payroll processing is becoming too complex or time-consuming for your organization, consider outsourcing it to a reputable third-party provider. They have the expertise to manage payroll efficiently and stay on top of legal and regulatory changes.

Remember, the key to proactive error resolution is a combination of technology, regular reviews, continuous learning, and prompt corrective action. By implementing these strategies, organizations can significantly reduce payroll errors and their implications.

Conclusion:

The potential impact of payroll errors goes far beyond simple financial ramifications; they can undermine employee morale and tarnish a company’s reputation. By investing in robust payroll processes and systems, organizations can minimize errors, boost employee morale, and protect their reputations. In this increasingly competitive corporate landscape, diligent and accurate payroll management is not just an administrative task—it’s a strategic imperative.