23 Aug Payroll on a Holiday: 6 Best Practices

6 Best Practices for Payroll on a Holiday

For businesses across the globe, holidays can be both a time of celebration and a potential cause of confusion, especially when they intersect with payroll dates. Employers and employees alike rely on consistent payroll processes to ensure timely and accurate payment. When a scheduled payday falls on a holiday, it can create logistical challenges and potential stress for employees. Let’s delve into this situation, understand its implications, and outline best practices for businesses.

The Challenge of Payroll on a Holiday.

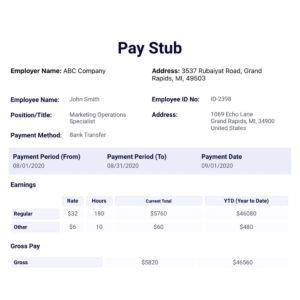

Typically, banks and financial institutions close on national holidays. If payday falls on a holiday, direct deposit transfers and check clearances might be affected, potentially causing delays in payment.

Potential Implications

Delayed Payments:

Employees depend on timely payments for their financial stability. Any delay can lead to potential financial strain or dissatisfaction.

Operational Complications:

Adjusting payroll for a holiday can add complexity to the payroll processing cycle, increasing the potential for errors.

Banking Fees:

In some cases, if transactions are attempted on bank holidays, employers may incur additional fees or penalties.

6 Best Practices for Employers when payroll falls on a holiday.

1. Advance Communication:

Forewarned is forearmed. Communicate with your employees in advance if there’s a potential disruption due to a holiday. This way, they can plan their finances accordingly.

2. Adjust Payment Schedules:

Consider adjusting your payment schedule so that employees are paid before the holiday. This can be a day earlier or even several days in advance, depending on the holiday calendar.

3. Ensure Compliance:

If you’re in a jurisdiction that mandates payment by certain dates, be sure to stay compliant. Some regions might require employers to pay their employees by the regular payday, irrespective of holidays.

4. Leverage Technology:

Modern payroll software often has features to adjust for holiday pay cycles automatically, minimizing manual intervention and reducing errors.

5. Consider Manual Interventions:

If for some reason there’s a disruption, having a process in place to issue manual or emergency payments can be beneficial.

6. Review Banking Partnerships:

Some banks might offer solutions or workarounds for businesses that frequently encounter this issue. It’s worth having a conversation with your bank about this.

Also Read: Best American Banks 2023.

How employees can deal with delays due to payroll on a holiday.

Stay Informed:

Understand your company’s payroll policies and ask in advance about potential holiday-related disruptions.

Plan Ahead:

If you know a holiday might impact your payday, plan your monthly expenses accordingly to avoid potential financial strain.

Open Dialogue:

If you encounter difficulties due to delayed payment, communicate with your HR or payroll department. They might have solutions or compensations in place.

Also Read: Open communication and its benefits in an organization.

Conclusion

While holidays are a time for relaxation and celebration, for businesses, they can introduce complexities, especially when they overlap with payroll. Proactive planning, open communication, and leveraging available technologies can ensure that both employers and employees have a smooth experience, even when payday coincides with festive times.